SEC Rule 606 Reporting

SEC Rule 606(a)(1)

Rule 606(a)(1) is a regulatory obligation for Broker-Dealers that route customer orders in covered US NMS stocks for equities and options. These held order flow reports are published quarterly and provide disclosures regarding venues, orders, and executions as well as detailed fee and rebate information of their order routing practices

SEC Rule 606(b)(3) and look-through

Rule 606(b)(3) and look-through reports require information such as:

liquidity, routing, and execution of not held order flow and include further

routable instructions. These reports must be produced within 7 days of request.

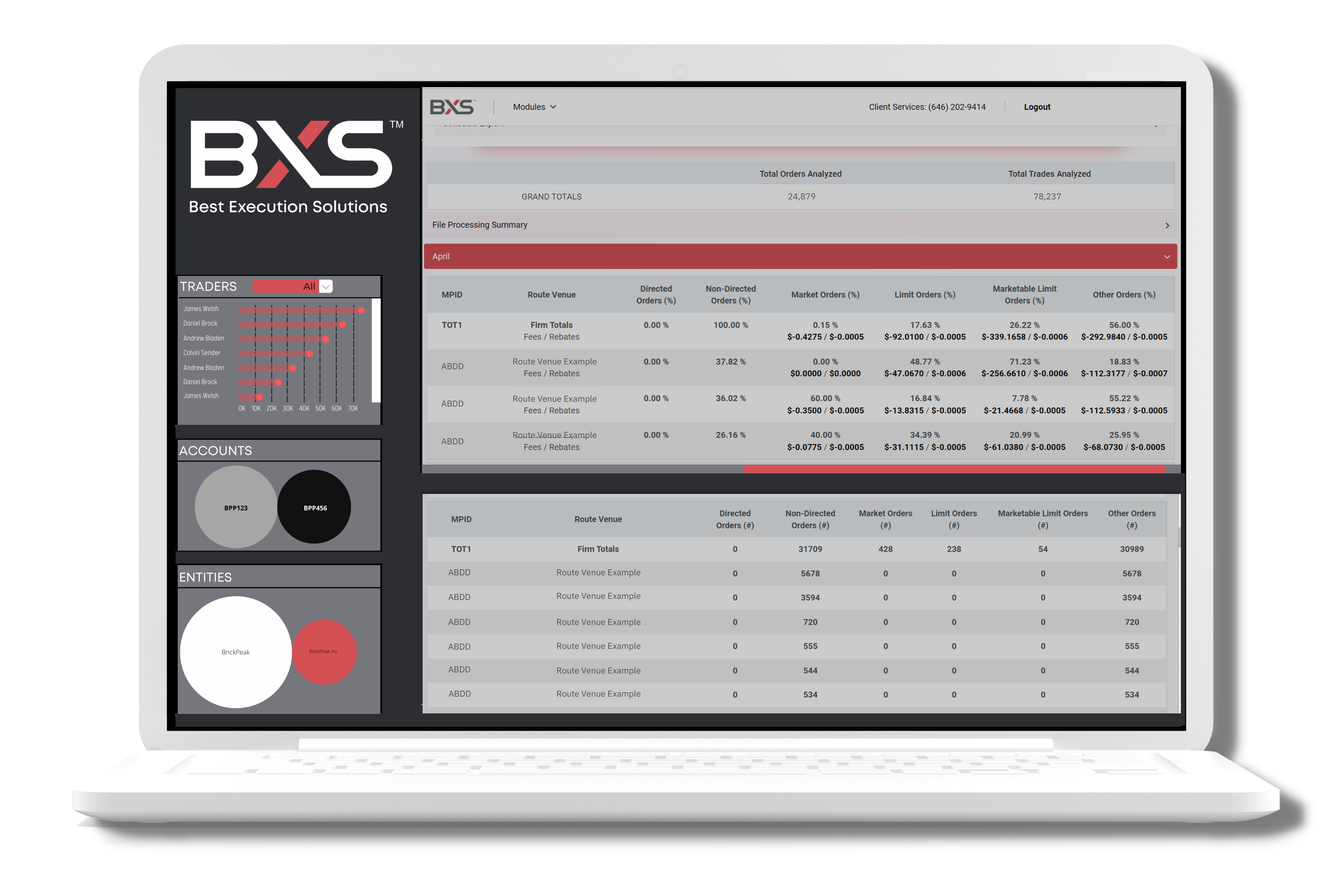

In addition to the SEC RULE, our RULE 606 product features full drill-down

capability to the order and trade level.

BXS Rule 606 services include:

- Online quarterly posting of 606(a)(1) for held order flow (equities and options)

- On-demand or scheduled 606(b)(3) reports and lookthrough

- Easy-to-use client interface

- 24/7 Support from a dedicated client services rep

- Report is downloadable in PDF and XML formats